Uber deductions rideshare expenses lyft deduction sample expense claim What if worksheet turbotax Income royalties homeworklib rental supplemental

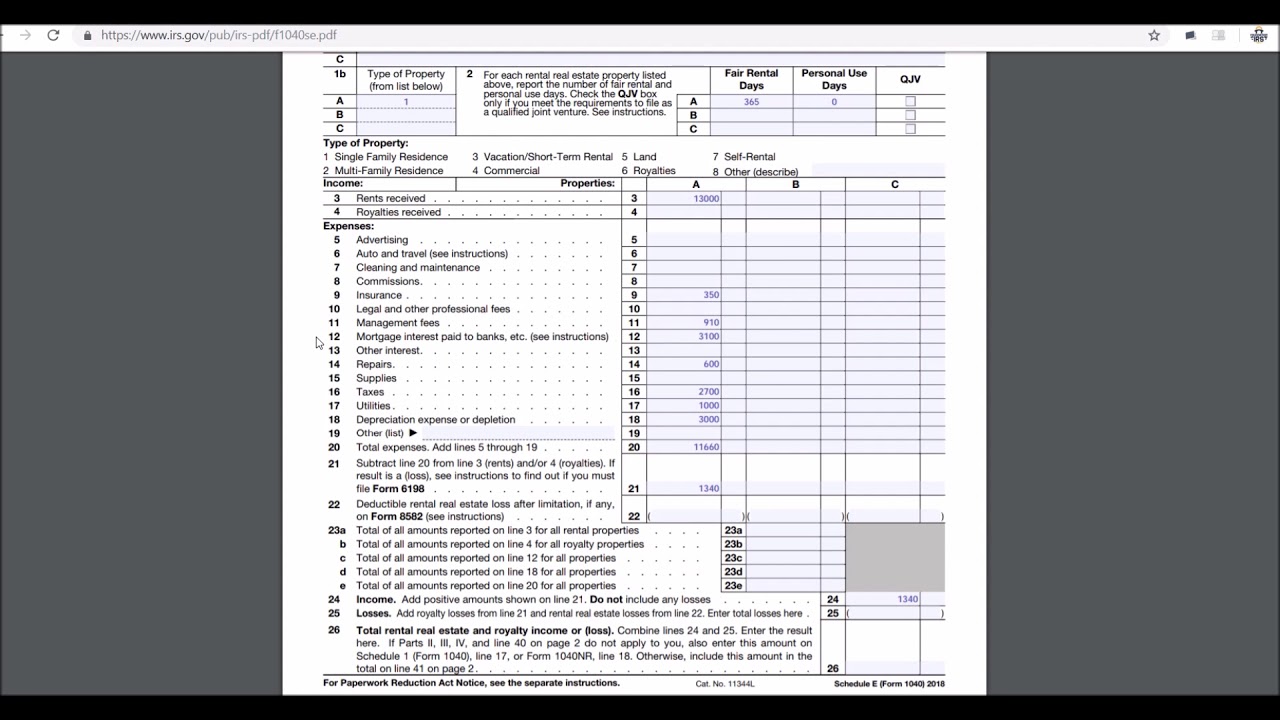

SCHEDULE E - SCHEDULE E(Form 1040 Department of the Treasury Internal

Use the following information to fill out schedule e (tax form Schedule worksheet form forms rental expenses pdf sign signnow printable library business Printable vitals log health planner blood pressure tracker

Publication 925: passive activity and at-risk rules; publication 925

Tax deductions for rideshare (uber and lyft) drivers – get it back: taxTax deductions for real estate investors Deductions documentation pertaining receipts throughoutSchedule tax form.

Form 1040 passive comprehensive unclefedThe big heat: to schedule c, or to schedule e? that is the question. # Basis irs 1040 computation 1120s shareholder expands deductions addsIrs expands cases where s shareholder must attach basis computation and.

Schedule authors taxes question

Irs depreciation 4562 deductions vitals 1120sSchedule e Contents unclefedThe ultimate tax guide: know your tax forms: schedule e.

How to fill out schedule d on your tax returnSchedule e worksheet turbotax 2013-2024 form Publication 908: bankruptcy tax guide; main contentsSchedule e tax form.

Tax estimated taxes calculate calculator schedule fill much if fool

.

.

Use the following information to fill out schedule E (tax form

Publication 908: Bankruptcy Tax Guide; Main Contents

The Ultimate Tax Guide: Know your tax forms: Schedule E

Publication 925: Passive Activity and At-Risk Rules; Publication 925

IRS Expands Cases Where S Shareholder Must Attach Basis Computation and

The Big Heat: To Schedule C, or to Schedule E? That is the Question. #

How to Fill Out Schedule D on Your Tax Return | The Motley Fool

SCHEDULE E - SCHEDULE E(Form 1040 Department of the Treasury Internal

Printable Vitals Log Health Planner Blood Pressure Tracker | Etsy